In 2024, it marks 5 years since the global economy began to recover from the consequences of the COVID- 19 pandemic, with macroeconomic conditions nearly returning to pre-pandemic levels.

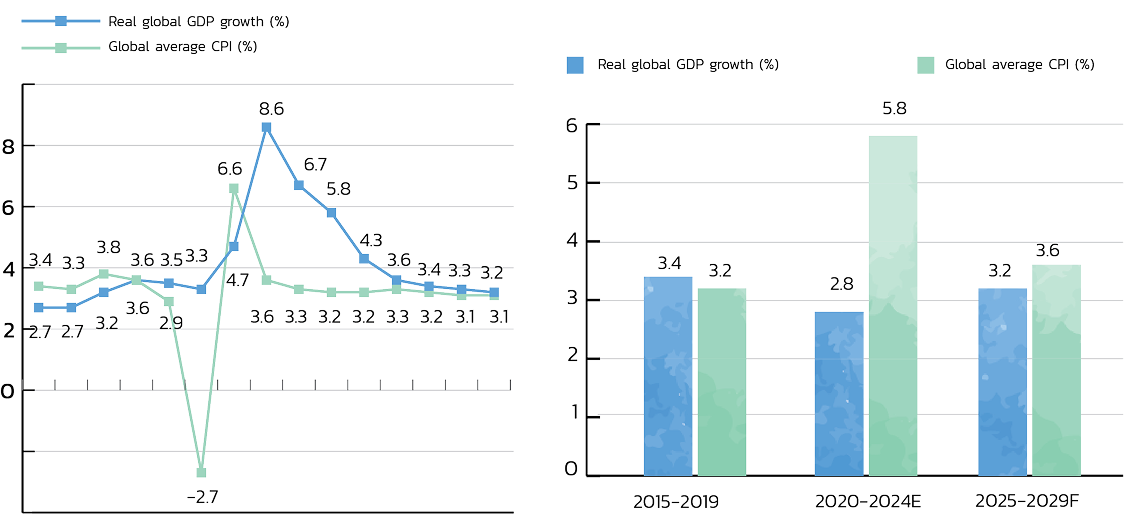

According to the International Monetary Fund (IMF) report, global economic growth in 2024 is expected to reach 3.2%. Inflation continues to decrease, and in many developed countries, inflation is gradually approaching central banks’ target levels, due to a sharp drop in the prices of food, energy, and goods. The global average Consumer Price Index (CPI) in 2024 is 5.8%, and it is expected to continue decreasing in the coming period. Global economic growth and inflation over the next 5 years are expected to return to a “normal” phase, with GDP growth forecast at 3.2%—slightly lower than the 5- year average before the pandemic, which was 3.4%— and the CPI is expected to rise slightly to 3.6%, up from 3.2% before the pandemic.

After the COVID-19 pandemic passed, global trade activities have recovered and gradually stabilized.

However, with many countries adopting protectionist trade policies, especially the escalation of the US – China trade tensions, global supply chains have faced new pressures. In response, global corporations are seeking ways to diversify their supply sources for raw materials and invest in technology development to optimize production processes.

In 2024, mitigating the impacts of climate change continues to be a key policy priority for many countries around the world. Strong investments in renewable energy and green technology have become trends for many countries and businesses. On a global scale, sustainable development policies and carbon emissions reduction have become key policy priorities for many governments and enterprises.

It can be stated that climate change is not only a challenge to global economic growth but also opens up new opportunities for the further development of the global economy.

General context

Global and Vietnam economies in 2024

Amidst the heavy impact of a globally unstable economy, Viet Nam’s economy has made impressive recovery and growth, demonstrating an increasing ability to adapt and innovate, continuing to stand out as a bright spot in the region and globally.

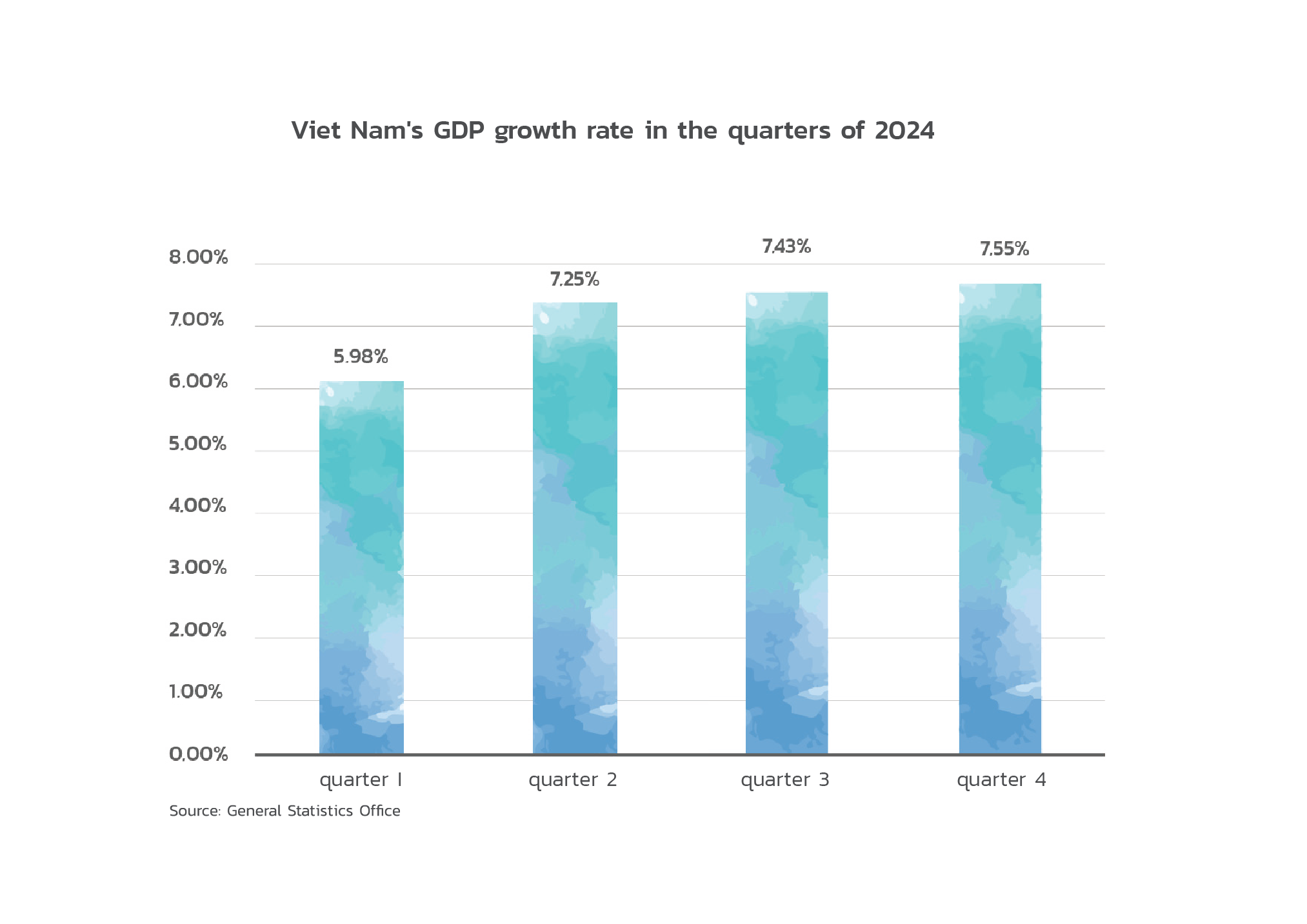

According to the General Statistics Office, Viet Nam’s economy in 2024 successfully achieved a growth rate of 7.09%, exceeding the target range of 6.5-7% set by the National Assembly. Growth has been maintained with a gradual increase through the quarters. The GDP at current prices in 2024 is estimated to reach 11,511.9 trillion VND, equivalent to 476.3 billion USD. The GDP per capita in 2024 is estimated at 114 million VND per person per year, equivalent to 4,700 USD, an increase of 377 USD compared to 2023.

The achievements of the year can be attributed to the appropriate development strategy and traditional growth drivers. The macroeconomy remains stable, with inflation controlled under 4%. In 2024, final consumption, including both household and government consumption, increased by 6.57% compared to 2023. The total trade turnover neared a record 800 billion USD. By the end of 2024, the total registered Foreign Direct Investment (FDI) in Viet Nam reached over 31 billion USD, placing Viet Nam among the top 15 developing countries attracting the most FDI in the world. Development indicators show that Viet Nam continues to be a safe and attractive destination, with effective removal of barriers to investment and business, creating momentum for businesses to recover and boost production activities. At the same time, pursuing the aspiration for economic prosperity, environmental sustainability, and social fairness, Viet Nam continues to accelerate the innovation of its growth model, restructure the economy toward the goal of becoming a regional leader in green growth, green recovery, and aligning with global development trends. The completion of institutional systems, streamlining government machinery, and enhancing the capacity and effectiveness of the political system are also key drivers that will contribute to achieving high economic growth, thereby enhancing competitiveness and promoting deeper international economic integration.

ACCORDING TO THE GENERAL STATISTICS OFFICE, VIET NAM’S ECONOMY IN 2024 HAS SUCCESSFULLY ACHIEVED A GROWTH RATE OF

7.09%

THE GDP AT CURRENT PRICES IN 2024 IS ESTIMATED TO REACH

11,511.9

trillion VND

THE GDP PER CAPITA IN 2024 IS ESTIMATED AT

114.000.000

VND/person/year

Electricity industry situation in 2024

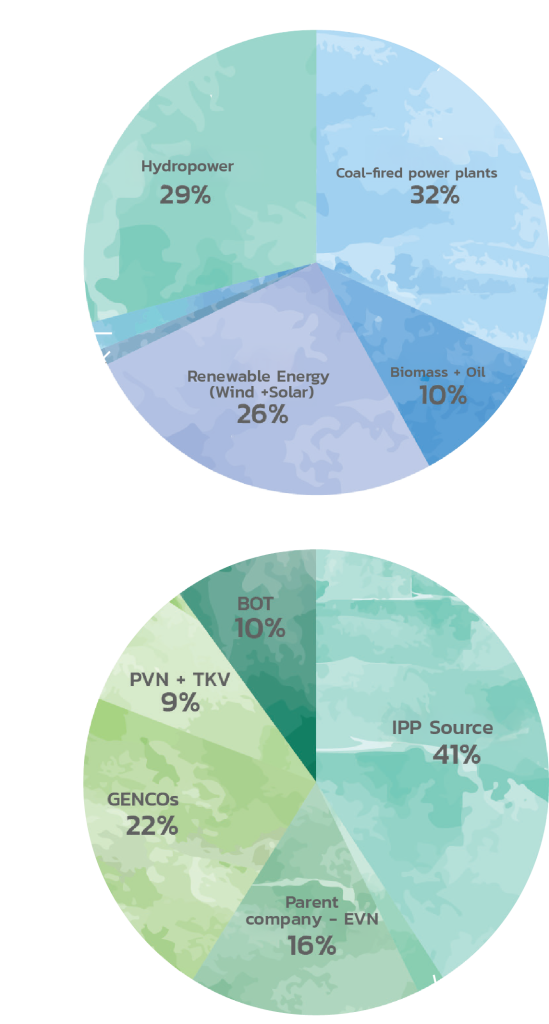

By the end of 2024, the total installed power capacity (with COD) of the entire electricity system will reach approximately

~82,400 MW

An increase of about ~1,500 MW compared to 2023

Electricity produced and imported by the whole system is

308.73 billion kWh

increase 9.9% compared to 2023

The scale of Viet Nam’s power system RANKS FIRST in the ASEAN region in terms of power capacity, of which the total power capacity of renewable energy sources is

21.447 MW

accounting for 26%

Maximum system load capacity Pmax

48,955 MW

increase 7.52% compared to 2023

Situation of production and business operations

In 2024, many fluctuating and unpredictable factors greatly affected EVNGENCO3’s power system operation as well as power production:

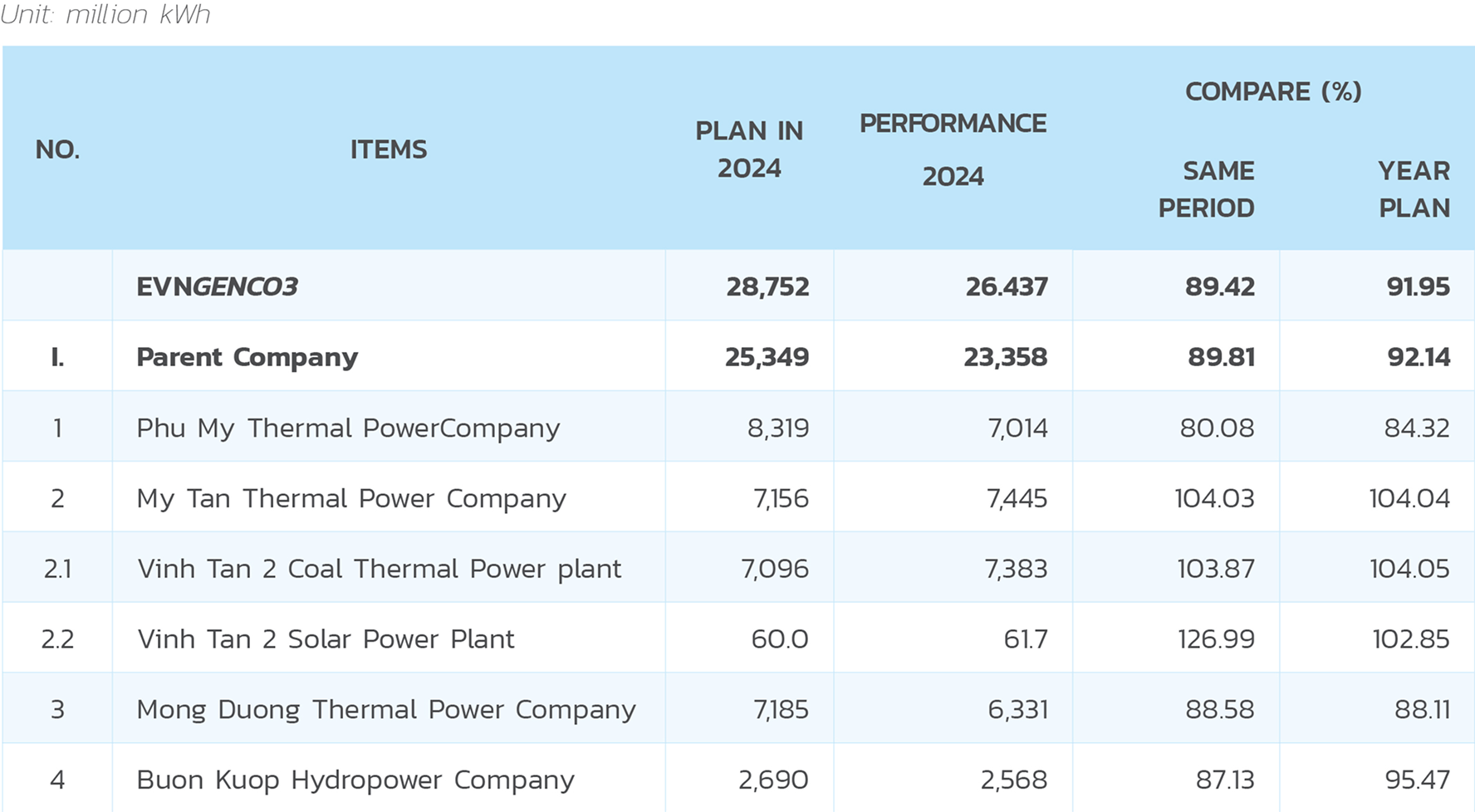

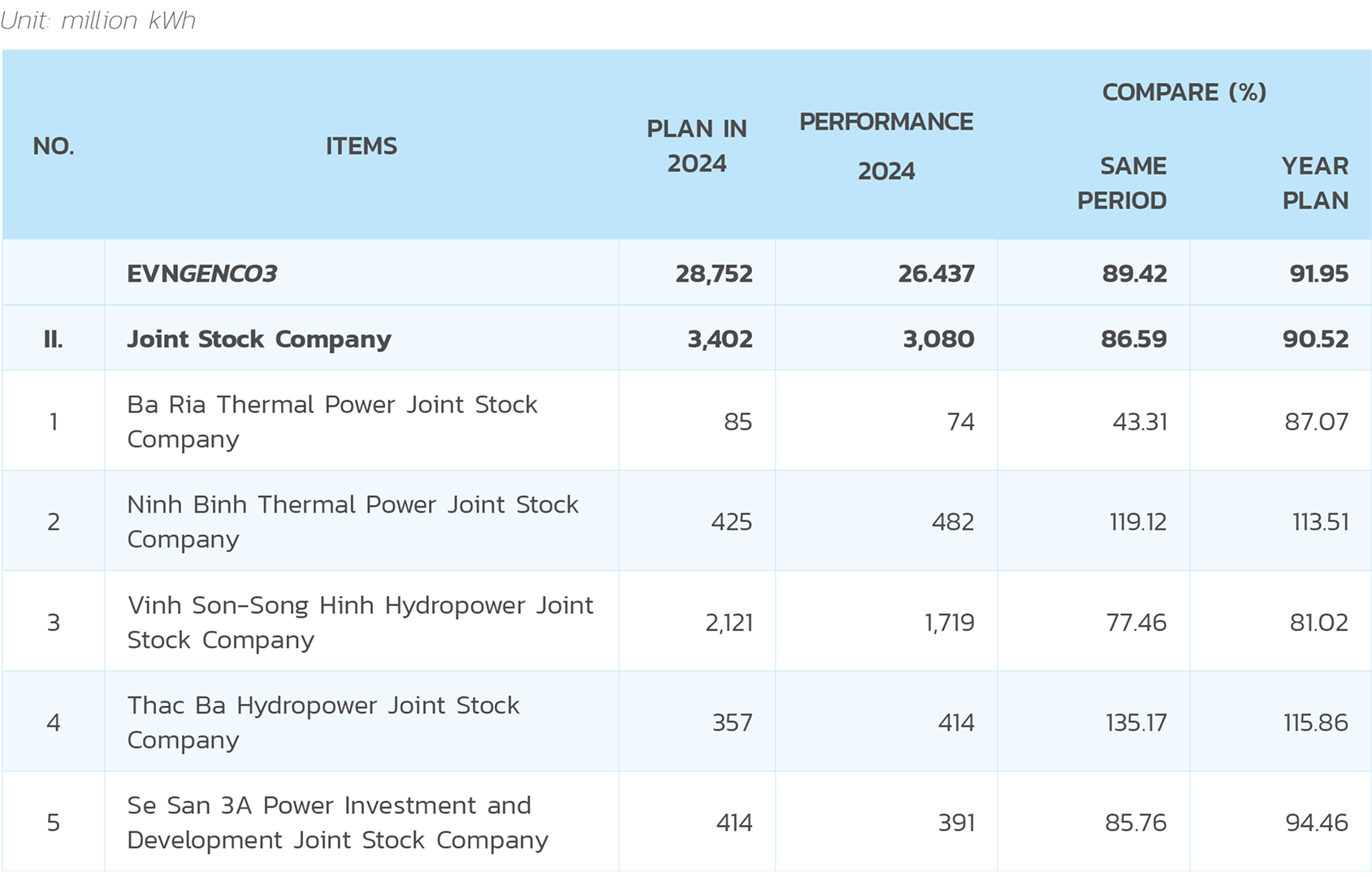

26.437 BILLION KWH

equivalent to 91.95% of the plan approved by the Annual General Meeting of Shareholders. Equivalent to 113.92% KH EVN/BCT. Of which

Dependent Accounting Units:

23.358

Billion KWH

equivalent to 92.1% GMS’s PLAN

(114.5%EVN’s PLAN)

JOINT STOCK COMPANY:

3.080

Billion MW

equivalent to 90.52% GMS’s PLAN

(109+.9% PLAN)

Comment:

In 2024, the power plants of EVNGENCO3 generally operate stably, meeting the dispatch requirements of the Power System (electricity output reached 114.47% of EVN’s plan and 109.09% of the BCT’s plan). Notably, with the high share of renewable energy sources (RES) in the current context, gas turbine units (Phu My, Ba Ria) have effectively met the demand during peak hours when RES generation is reduced and also effectively met the peak load coverage requirement using re-gasified LNG during the dry season months peak of 2024 (LNG-based generation in 2024 at Phu My’s plants reached approximately 380 million kWh).

The lower electricity output was mainly due to: (i) The continued priority dispatch of renewable energy sources, leading to lower thermal power generation (RES accounted for about 12.8% of total system output, achieving about 104% compared to 2023); (ii) A sharp decrease in domestic gas supply, with gas power accounting for about 7.1% of system output, only reaching about 82.8% of 2023 levels; (iii) High dispatch of BOT coal-fired thermal power plants; (iv) Low contract electricity output (Qc) from Phu My and Vinh Tan 2 power plants, with particularly low output from Vinh Tan 2, which was not allocated electricity output in the January- February 2024 dispatch method (Qc=0).

Ensure fuel for electricity production

GAS FUEL

Domestic Gas:

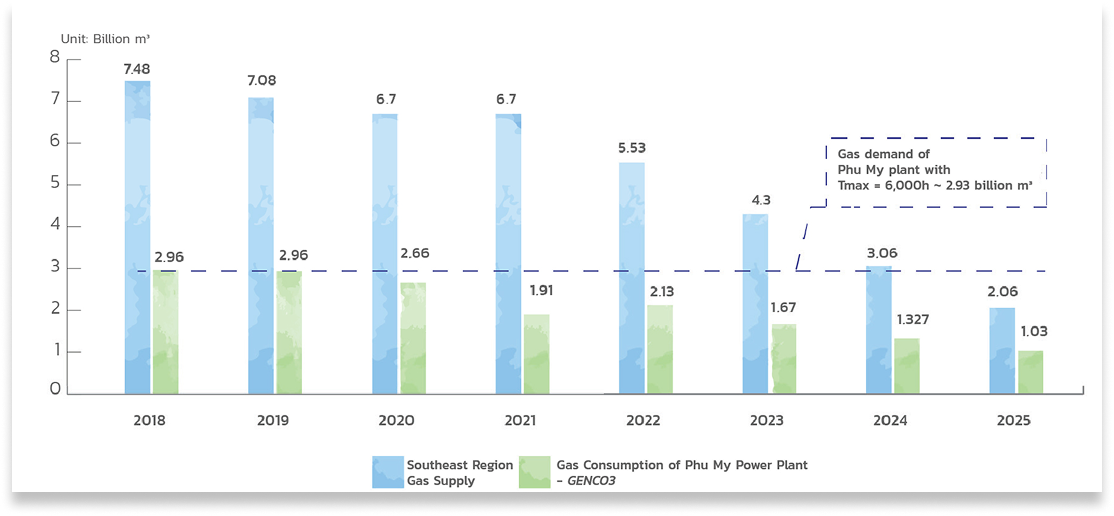

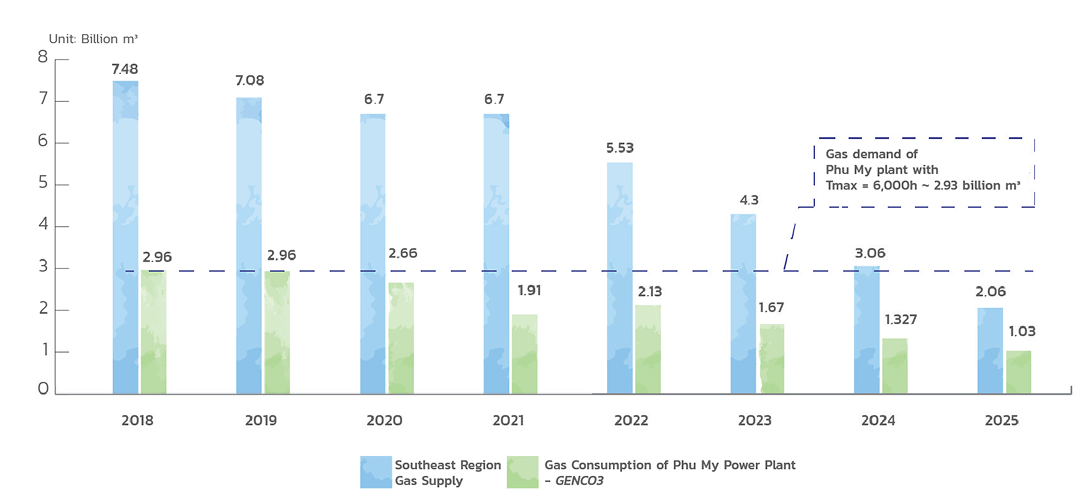

The domestic gas supply in the Southeast region has been decreasing year by year, with an estimated supply of 3.06 billion m³ in 2024 (a decrease of 28.84% compared to 2023), averaging 8.3 to 9.2 million m³ per day.

The total gas consumption for power generation in Southeast region for the entire year is 2.78 billion m³, averaging approximately 9.11 million m³ per day. Of this, the gas-fired power plants at Phu My – GENCO3 consumed about 1.33 billion m³, averaging around 3.63 million m³ per day.

LNG:

Domestic gas sources basically meet the demand for electricity production according to the dispatch of the power system. However, domestic gas is insufficient to meet the increased load demand at certain times during the peak of the dry season in April-May 2024. Therefore, the Phu My gas-fired power plants were mobilized to operate using regasified LNG. The total amount of regasified LNG consumed by the Phu My power plants – GENCO3 in 2024 was approximately 73.4 million m³ (370 million kWh)

COAL FUEL

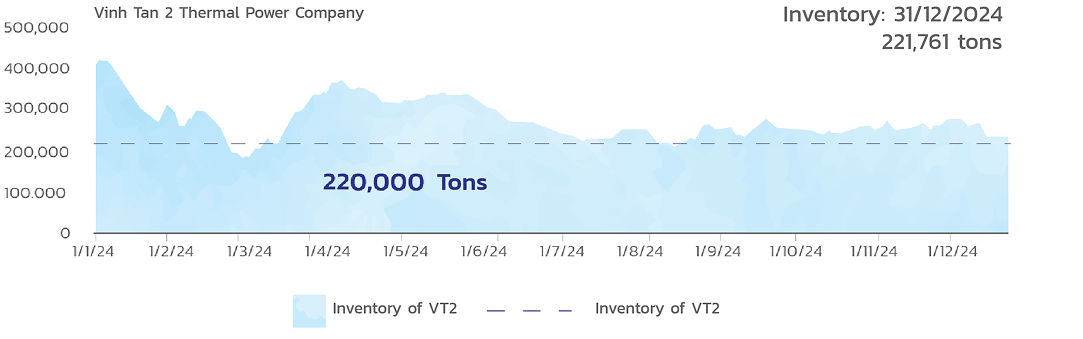

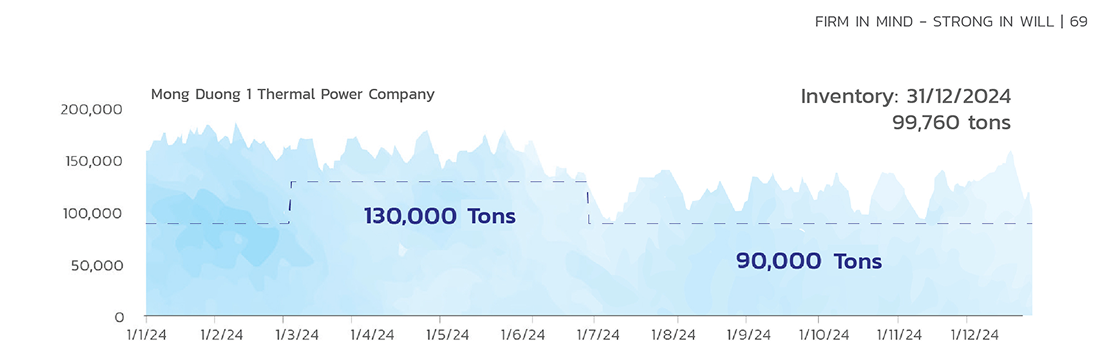

In 2024, the coal supply for EVNGENCO3’s power plants met the electricity production requirements based on the dispatch of the national power system and was above the minimum stock levels.

Specifically, the coal supply situation is as follows:

– Vinh Tan 2 Thermal Power Company: 3.391 million tons (TKV: 1.518 million tons; Northeast Corporation: 1.682

million tons; other suppliers: 190 thousand tons).

– Mong Duong 1 Thermal Power Company: 2.937 million tons (TKV: 2.37 million tons; Northeast Corporation: 0.57 million tons)

– Coal inventories by day of factories are as follows:

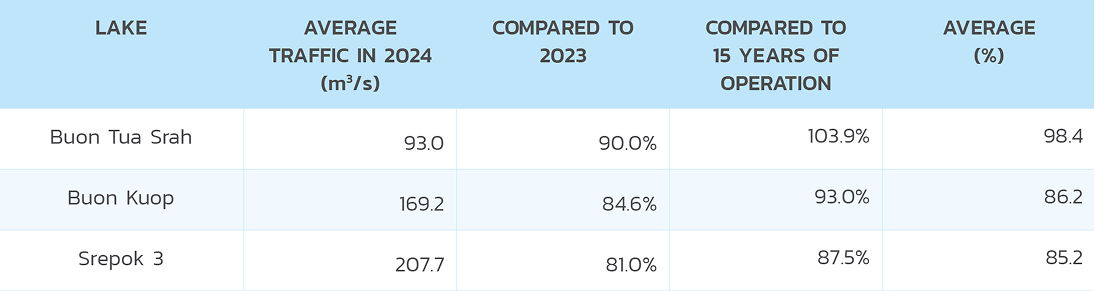

HYDROLOGICAL SITUATION

The hydrological situation during the year is volatile and difficult to forecast, causing difficulties in production and business planning.

In 2024, the average water flow to Buon Tua Srah Lake is lower than the same period in 2023 and approximately the average water flow to Buon Kuop and Srepok 3 Lakes is lower than the same period last year and lower than the average.

Gas supply and consumption situation in the period 2018 – 2025 (million m³/day).

Gas price:

– Average gas price in 2024 is 8.846 USD/mmBTU, up 6% compared to 2023.

– The proportion of high-priced gas sources is increasingly large (Sao Vang – Dai Nguyet and Thien Ung gas accounts for 61.3%, an increase of 7.0% compared to 2023).

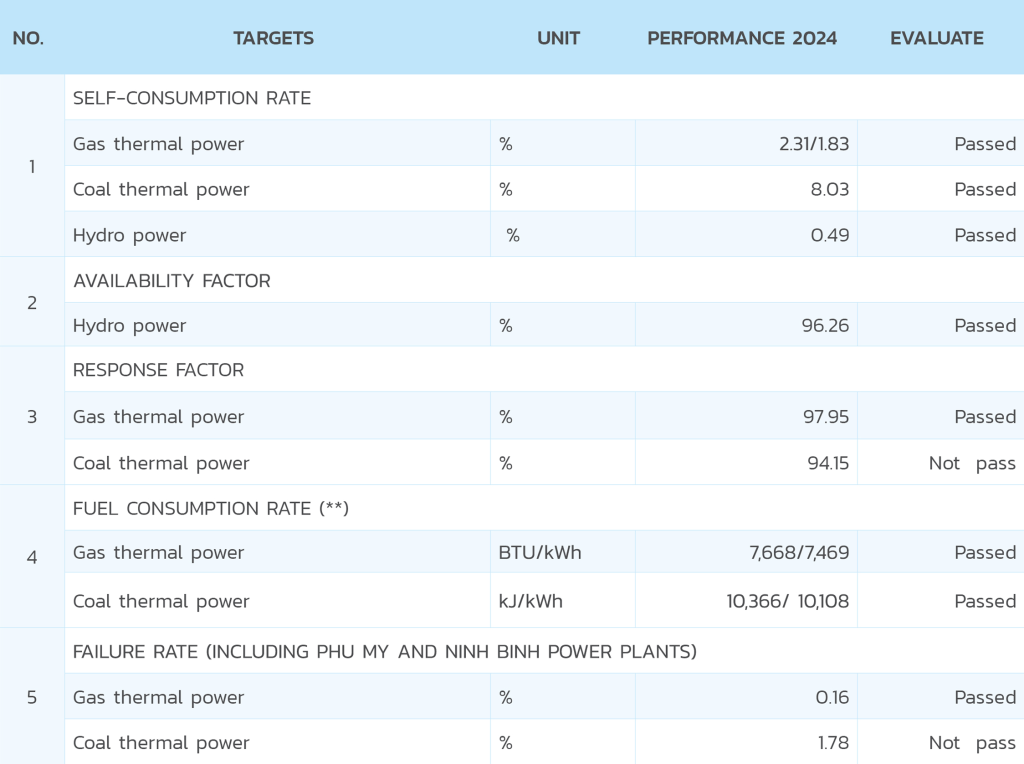

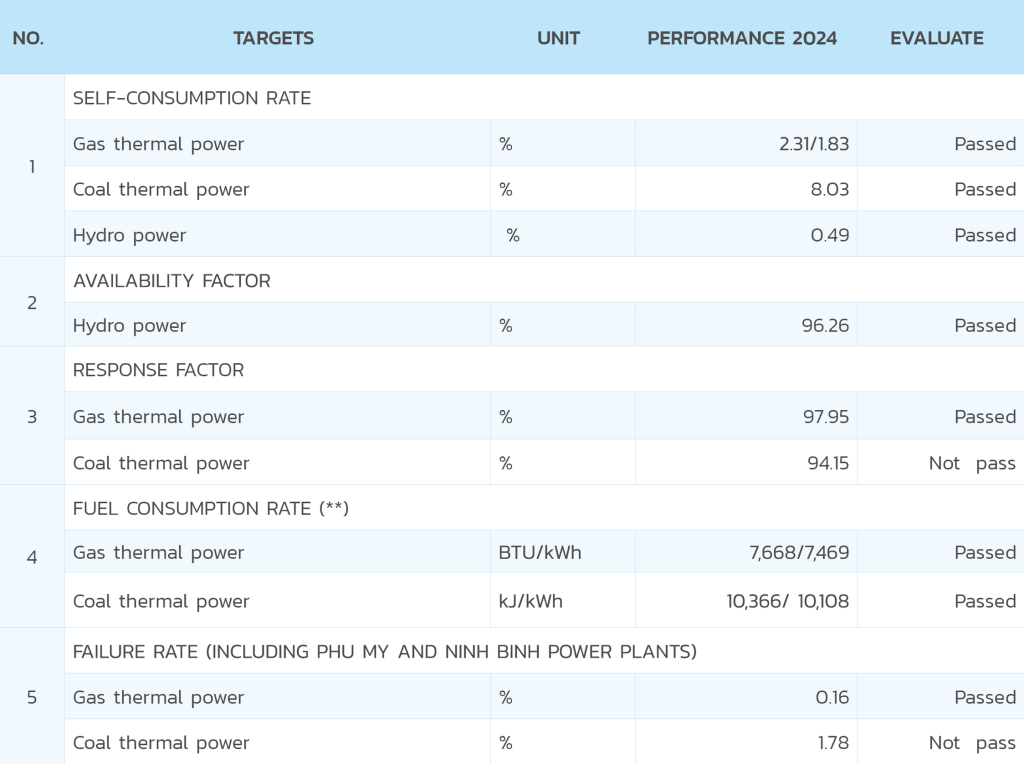

Regarding the heat consumption rate target for coal-fired thermal power: The implementation of the heat consumption reduction project has been carried out comprehensively with several solutions. The results for 2024 show that Vinh Tan 2 Thermal Power Plant has reduced the heat consumption rate by 82 kJ/kWh, and Mong Duong 1 has reduced it by 23 kJ/kWh compared to 2023. EVNGENCO3 has been and continues to implement many solutions to improve reliability, enhance operational efficiency, and reduce self- consumption, aiming to bring the coal heat consumption rate to the PPA rate by 2025. Specific actions include:

– Continuing the implementation of the 2021 – 2025 reliability and operational efficiency improvement project for power plants.

– Installing variable frequency drives (VFDs) for the 2B and 1A/1B furnace fans at Mong Duong 1 Power Plant

– Installing solar power systems for self-consumption at Vinh Tan 2 and Phu My Power Plants.

– Continuing to implement various solutions to adjust the operation modes of equipment systems, improve steam parameters, and reduce losses, such as: increasing main steam pressure, improving steam reheat temperature reducing coal mill operational flow, optimizing the compressed air system, and installing variable frequency drives for large motors,…

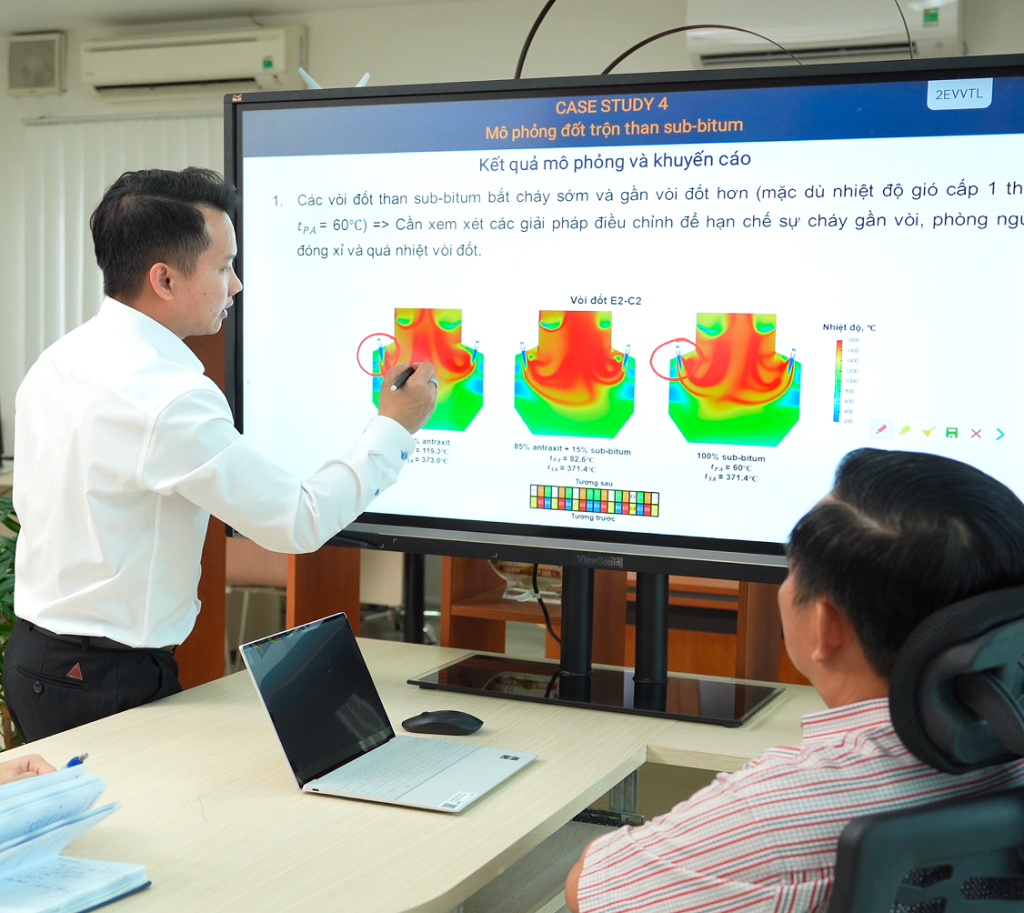

– The mixed coal program at Vinh Tan 2 has proven highly effective, as it provides suitable imported coal for blending, and the blended coal specification, which closely matches the designed coal specification, helps stabilize and improve efficiency without clinker formation.

– The experiment of blending sub-bituminous coal with anthracite coal at Mong Duong 1, with up to 30% sub-bituminous coal, aims to reduce variable costs and increase competitiveness in the power market.

– The power plants have applied the results of Reliability-Centered Maintenance analysis in repair work. Notably, the plants at Buon Kuop have implemented RCM analysis in their maintenance work, which has significantly increased operational reliability, with only about one fault per year from 2020 to now.

– Strengthening fabrication, processing, and recovery work to proactively ensure materials, shorten repair time, and save costs.

Regarding the failure rate and response rate targets for coal-fired thermal power, these have not been achieved mainly due to the high incidence of furnace tube ruptures at Mong Duong 1. Mong Duong Thermal Power Plant has coordinated with EPS Company to replace the 2A/2B furnace that was replaced during the Lunar New Year 2025.

Digital transformation

CONTINUING THE IMPLEMENTATION OF THE DIGITAL TRANSFORMATION PLAN FOR THE 2023-2025 PERIOD OF THE CORPORATION WITH 22 TASKS, INCLUDING 16 TASKS IMPLEMENTED ACCORDING TO THE GROUP’S PLAN AND 6 TASKS IMPLEMENTED INTERNALLY WITHIN THE CORPORATION.

Main digital transformation activities implemented in 2024:

Digitalization of Internal Processes: Continue developing the Workflow system, having completed the digitalization of 50 processes and currently testing 07 processes.

Optimized Fuel Management at Power Plants: Conduct research to develop a coal inventory management program (Vinh Tan and Mong Duong Thermal Power Plants), propose an optimal blending ratio to balance coal supply planning with electricity production planning, maintain optimal inventory levels, and maximize economic benefits for plant operations while effectively controlling coal stock losses.

Application of IT in Modern Financial Management: Implement according to EVN’s general plan. The Corporation has successfully deployed electronic payment (E-Payment) for capital allocation within the Corporation and salary disbursement across all units.

Implementation of the Smart Warehouse Management System (WMS) and Standardization of Material Codes (eCAT): WMS and eCAT were successfully deployed in 2023. Currently, efforts are underway to integrate WMS and eCAT with the QR Code-based inventory management software while adding automation tools to streamline data entry processes and enhance system efficiency.

Upgrade of the E-Logbook Software: The upgrade is ongoing, with continuous improvements and additions to enhance its functionality. Key updates include: A self- managed maintenance module; A work order management module for major repairs; An iOS version for mobile devices,… The upgraded system is scheduled to be operational starting from August 2024.

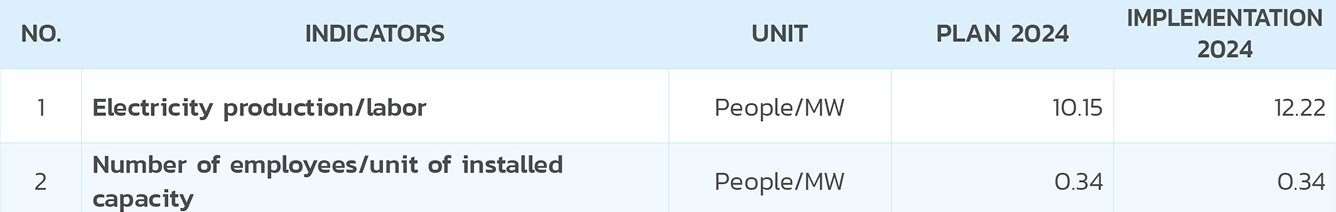

Overview of human resources in 2024

EVNGENCO3 always values the strength of its human resources, considering it a key factor in determining the corporation’s sustainable development. Over the years, EVNGENCO3 has continuously managed its operations in a flexible and advanced manner, developing a sustainable corporate governance model and corporate culture—creating motivation for employees to maximize their potential and maintain long-term commitment to the Corporation.

Human resource structure

As of December 31, 2024, the total number of employees at the corporation’s headquarters and affiliated units was 2,150.

POLICIES AND CHANGES IN POLICIES REGARDING EMPLOYEES

Labor and salary policies

EVNGENCO3 continuously enhances policies and benefits for employees. The Collective Labor Agreement (CBA) of the Corporation includes 49 provisions that benefit employees beyond the legal requirements of labor law. Notable among these are flexible working policies, benefits for female workers, and the provision of paid leave, including holidays, annual leave, and personal leave as stipulated by the Labor Law.

The wage and bonus system for employees is aligned with the job level and nature of work, ensuring full compliance with social insurance, and unemployment insurance contributions as per legal requirements. Regular health check-ups are organized for all employees.

EVNGENCO3 has issued regulations and guidelines related to labor management, wages, training, and rewards, which not only comply with state regulations but also incorporate the unique characteristics of the Corporation. These policies aim to motivate employees to work efficiently, foster a strong sense of cohesion, and align with the Corporation’s long-term sustainable goals and values.

Labor policy to ensure the health and social welfare of employees

In addition to wages and bonuses, EVNGENCO3 implements various welfare programs for its employees, such as regular health check-ups, in-depth health screenings for female employees, occupational disease examinations, and insurance programs that exceed the state-mandated levels. These programs provide comprehensive care for employees, motivating them to continue striving, dedicating themselves, and maximizing their potential.

EVNGENCO3 regularly reviews and adjusts its welfare policies, adding more practical benefits to ensure the well-being of all employees.

Training policy

Focusing on human resource development is one of the top priorities of the company. Therefore, EVNGENCO3 always emphasizes training and fostering human resources, developing digital human resources, and continuously improving professional knowledge, skills, and ethical standards for its staff. This is aimed at meeting the increasingly demanding needs of the market, in line with integration trends and the energy transition in the current context.

In practice, EVNGENCO3 regularly organizes training activities linked to its production and business tasks, training corporate management staff, and fostering professional, modern management. This ensures that every year, the management team participates in advanced training courses on both professional knowledge and management skills. EVNGENCO3 places great emphasis on implementing a specialized training program aimed at gradually replacing foreign experts in major repair projects, with the goal of eventually mastering the technology for repairing power plant units. As a result, EVNGENCO3’s team of technical managers and highly skilled workers has gradually replaced foreign experts in major repairs and has now become a trusted partner, sharing experience and providing power plant operation and repair services to other units.

Each year, the company trains over 12,000 sessions, especially through extensive use of E-learning, with an average of 23 sessions per employee per year, helping save costs and allowing employees to participate in training anytime and anywhere.

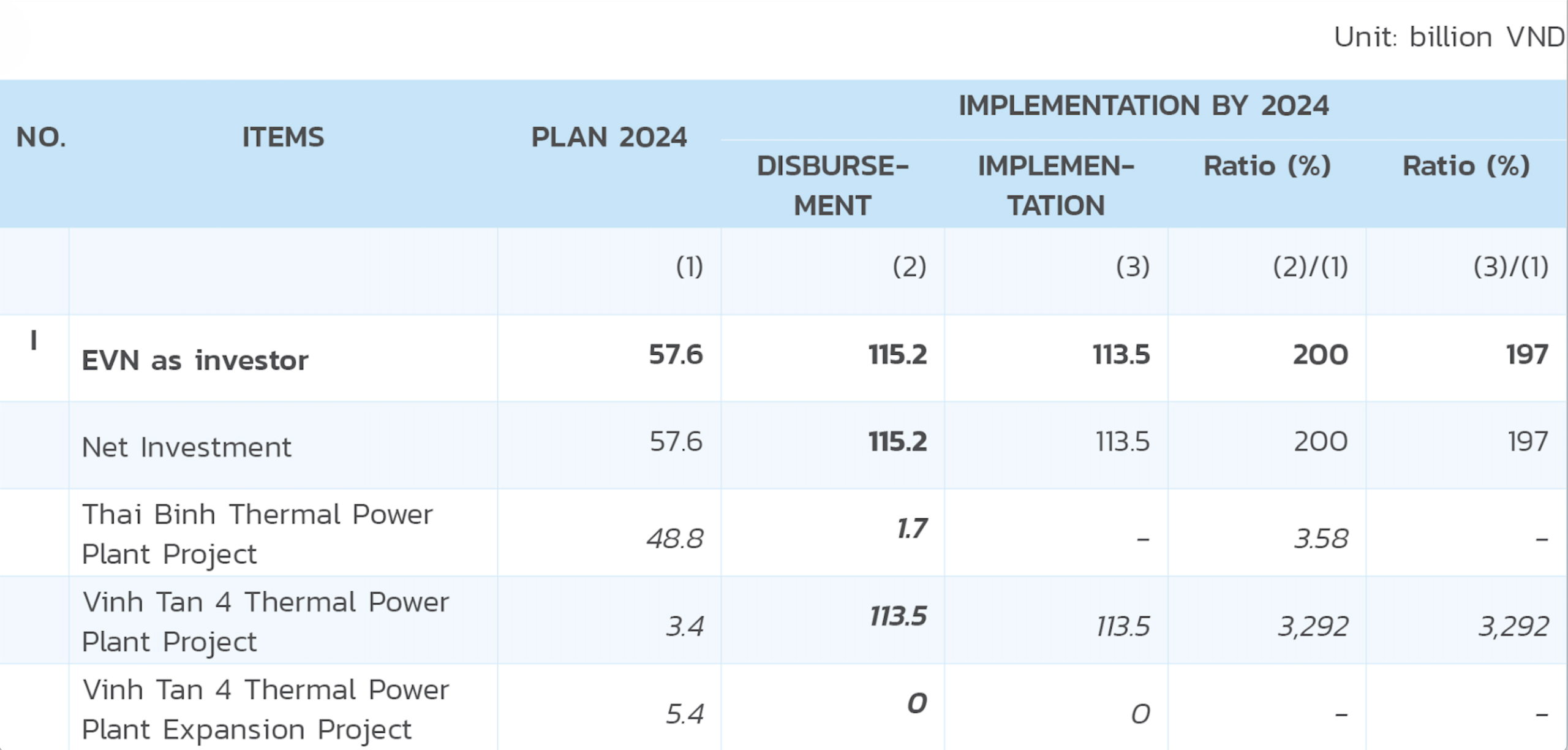

Investment and implementation situation of projects

Implementation status of the investment and construction plan in 2024

Value implementation and disbursement situation in 2024

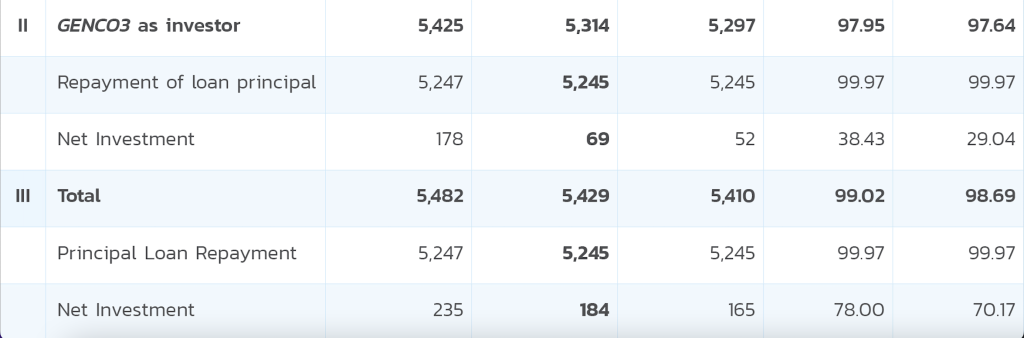

The total value of construction investment implemented in 2024 is estimated to achieve 99.02% Compared to the plan, with projects where the Corporation is the investor reaching 97.95% compared to the plan. Specifically:

The net investment value of the projects where EVNGENCO3 acts as the project management consultant has reached 200% of the planned capital. Due to difficulties in the investment preparation procedures, which have been prolonged, the actual investment value of the projects where evngenco3 is the investor has only reached 38.43% of the planned capital for 2024.

Investment promotion projects

Summary report on production and business operations and financial situation of subsidiaries, affiliates, capital contributions

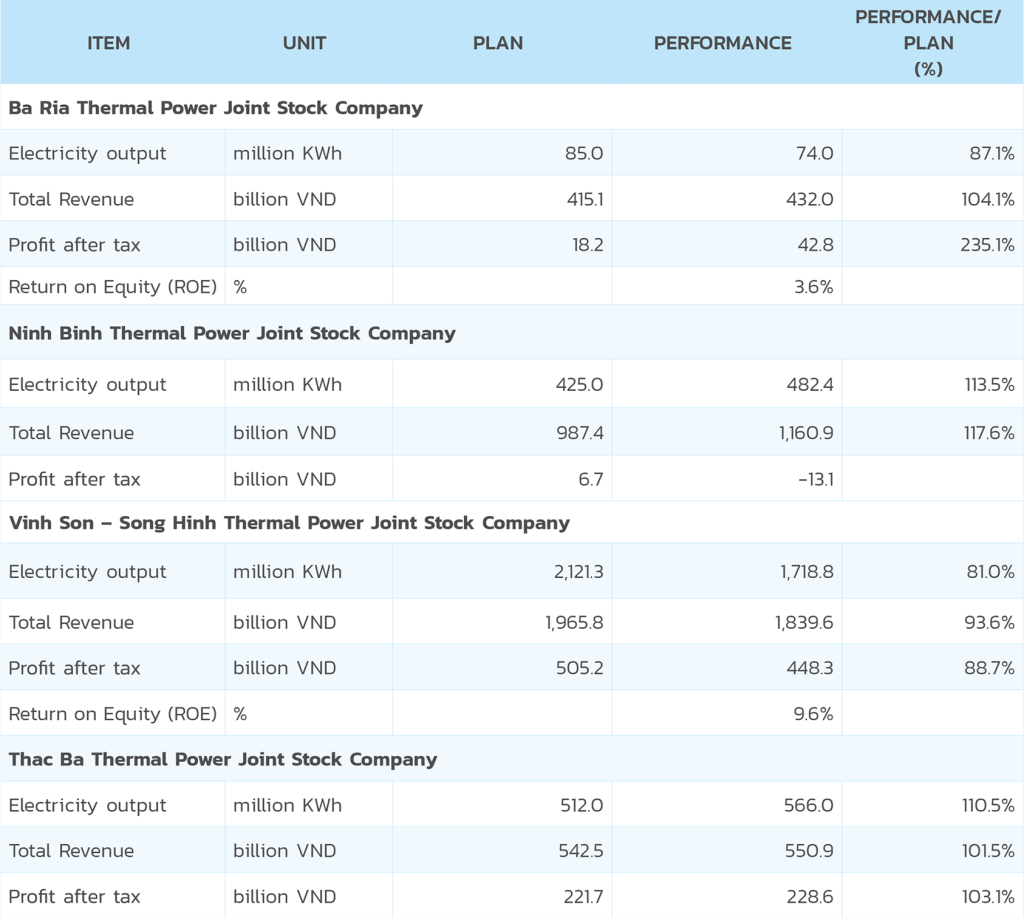

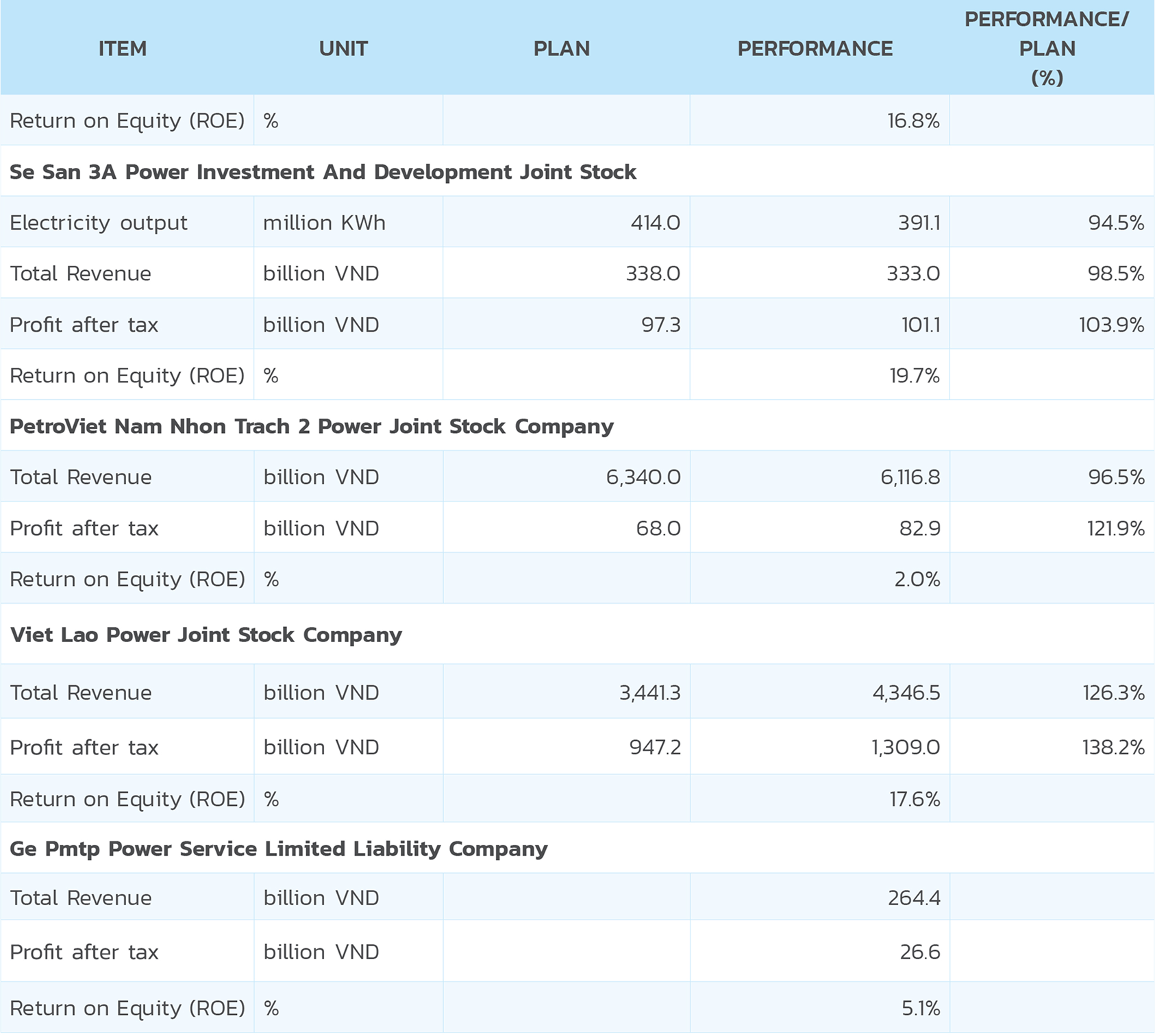

Production and business results in 2024 of subsidiaries, affiliates and capital contributions are as follows:

Financial situation

Production and business situation

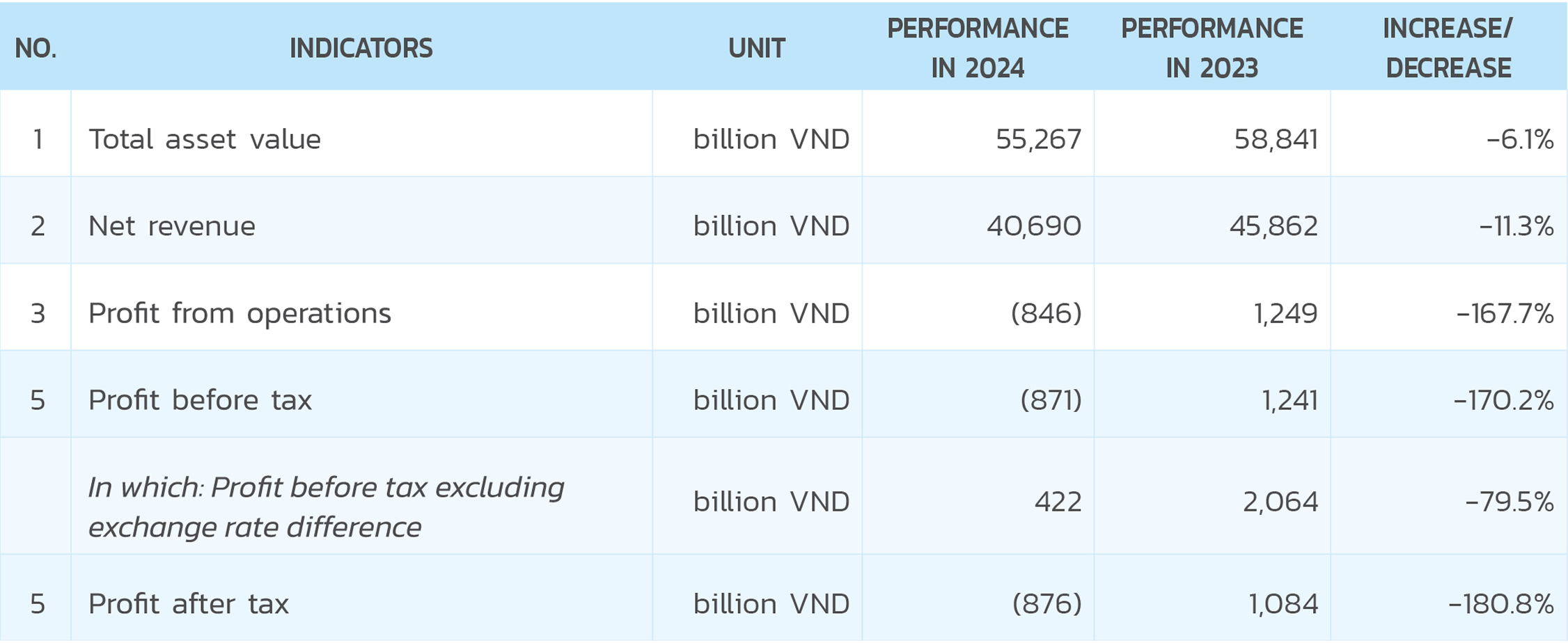

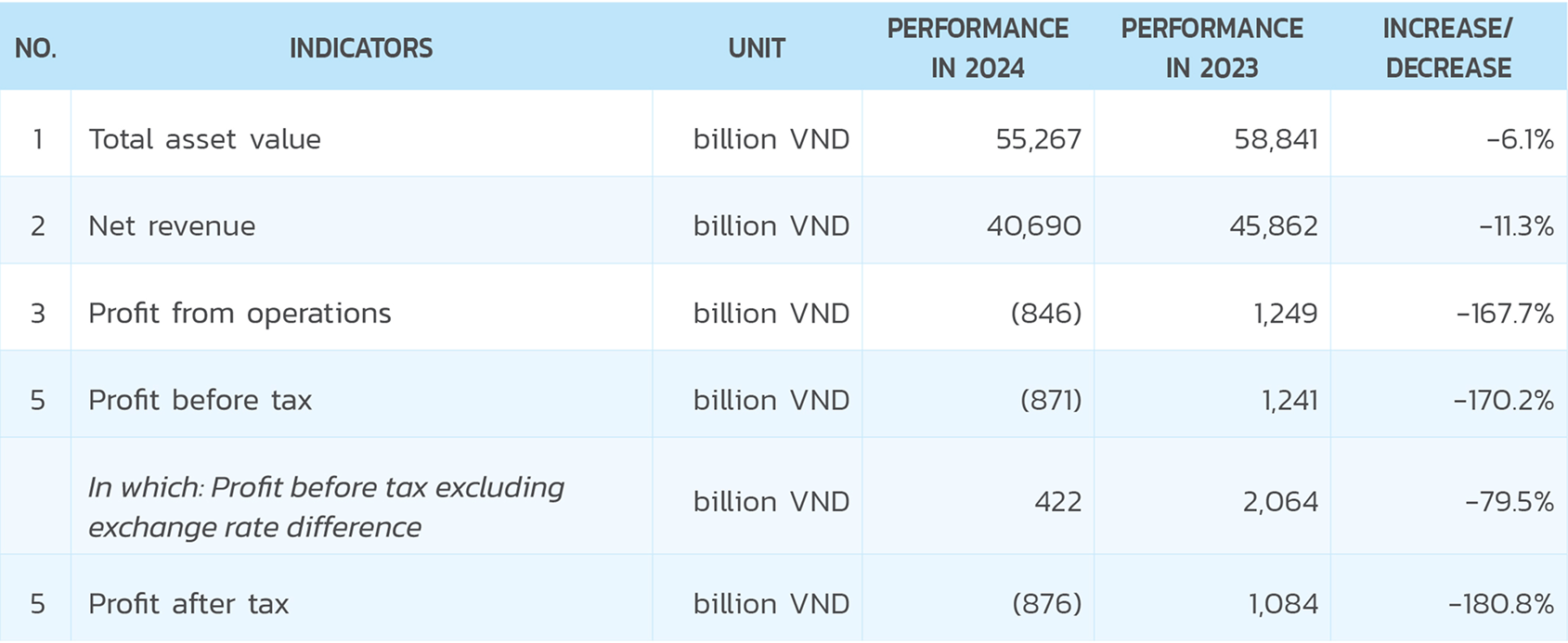

The Corporation’s consolidated business results in 2024 are as follows:

Remarks: Total assets in 2024 were 55,267 billion VND, a decrease of 6.1% compared to 2023, mainly due to the depreciation of fixed assets. Consolidated net revenue was 40,690 billion VND, down 11.3%; after-tax profit was a negative 876 billion VND, a decrease of 180.8% compared to the same period. The main reasons for this are:

• Electricity output was 2.59 billion kWh lower than the same period last year.

• Foreign exchange difference: The USD/VND exchange rate as of December 31, 2024, increased by 4.63% compared to the beginning of the year, leading to an increase of 470 billion VND in foreign exchange losses in 2024 compared to 2023

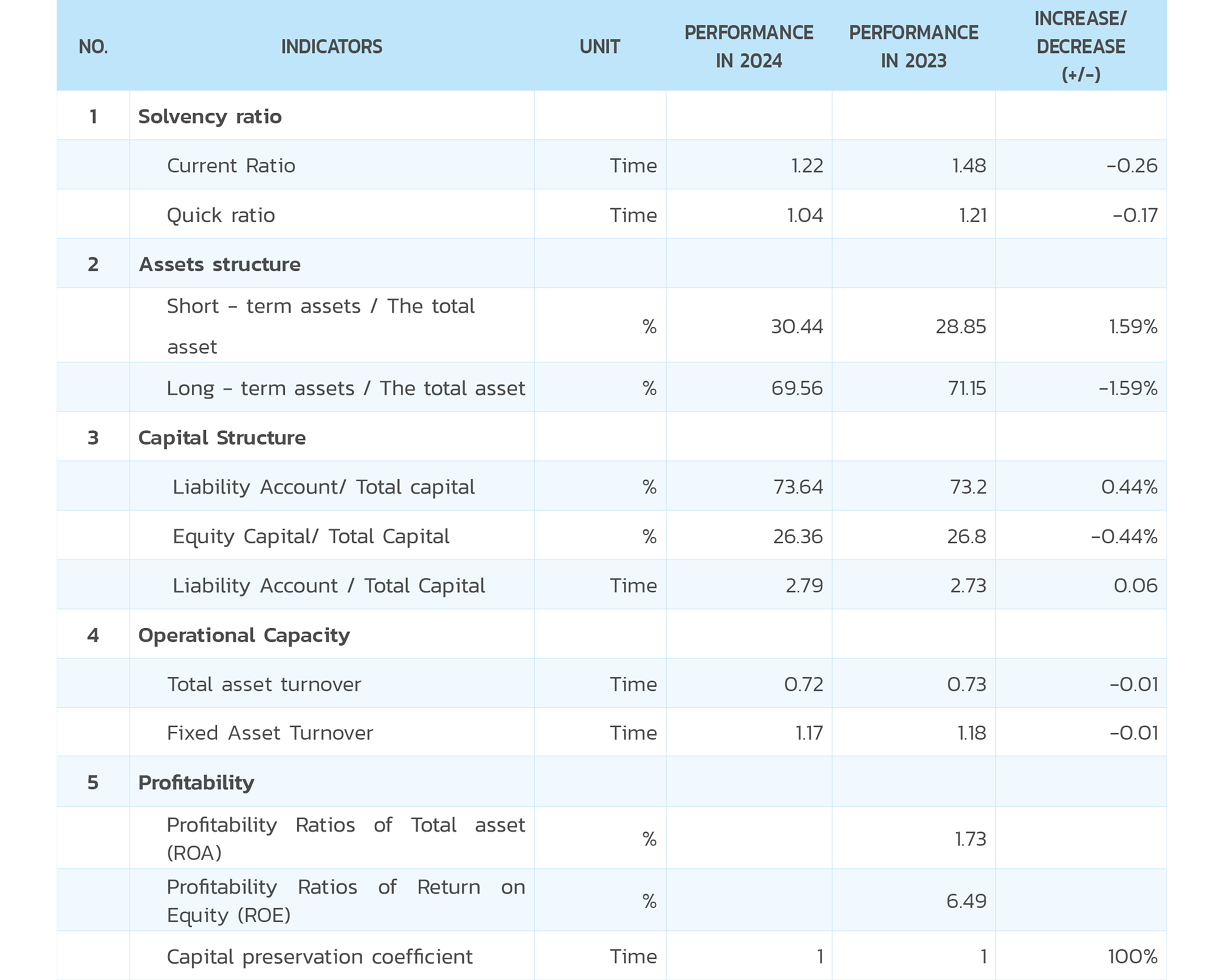

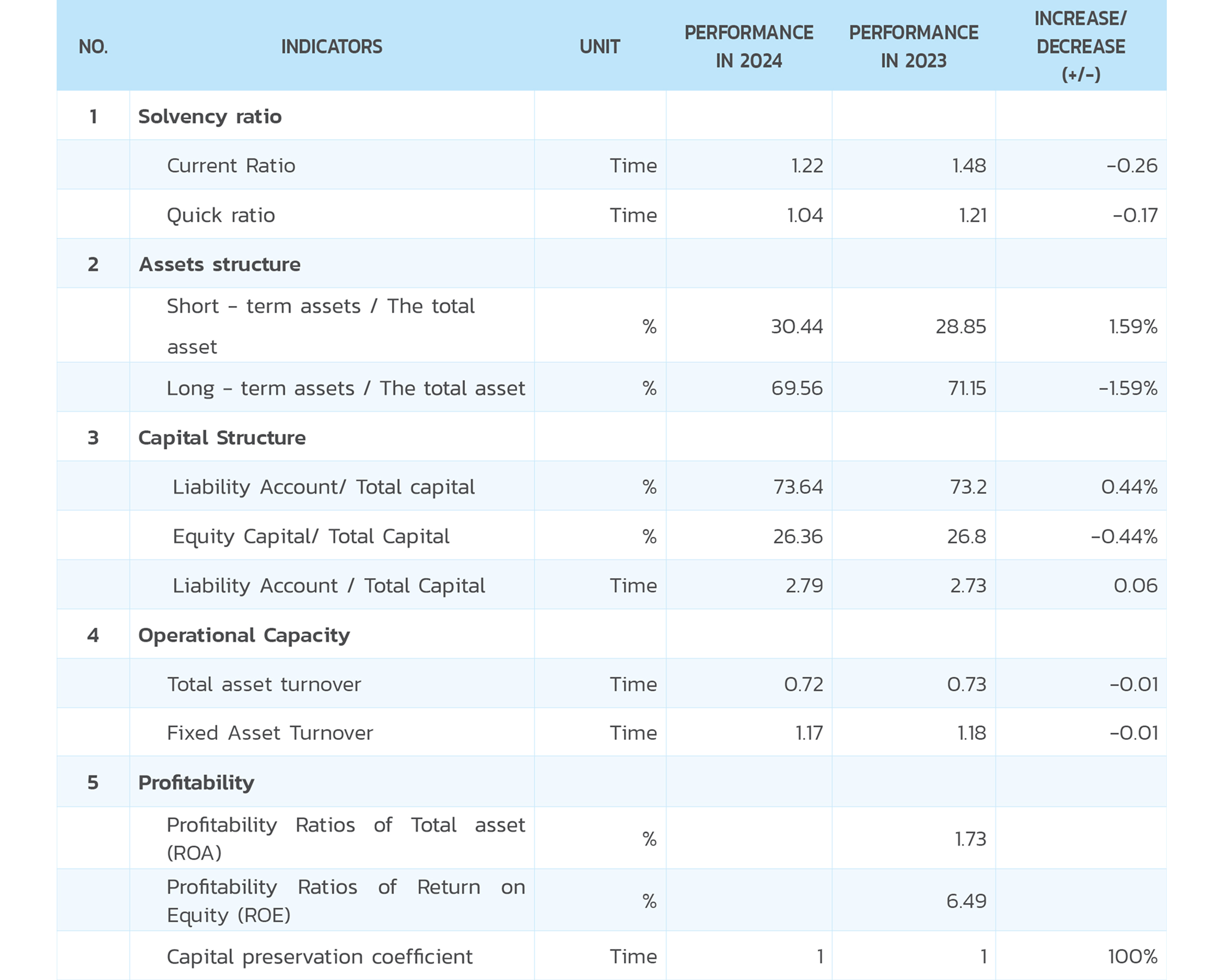

FINANCIAL STATEMENT 2024 REVIEW

Regarding liquidity: in 2024, EVNGENCO3’s current ratio was 1.22 times, and the quick ratio is 1.04 times, slightly decreasing compared to 2023. Over the past years, EVNGENCO3 has consistently maintained short-term and quick liquidity ratio above 1, demonstrating the company’s ability to meet its short- term debt obligations.

Regarding capital structure: EVNGENCO3 operates in the electricity production and trading, where the financial characteristic of power plants involves relatively high debt ratios. In 2024, liabilities accounted for 73.64% of the total capital of the company. EVNGENCO3 has a stable income from its electricity production activities, and the company has developed a long-term debt repayment plan, with decreasing loan liabilities over the years. The capital structure of EVNGENCO3 is becoming healthier, with financial leverage decreasing over time. The debt/equity ratio 2.79 times, ensuring financial safety.

Regarding operational capacity: The total asset turnover ratio and fixed asset turnover ratio were equivalent to 2023. Given the specific nature of its business operations, which involve the use of significant fixed assets, EVNGENCO3 consistently focuses on managing operating costs to enhance asset operational efficiency. Simultaneously, EVNGENCO3 has consistently prioritized fixed asset maintenance and repair activities in recent years.

Result: Overall, EVNGENCO3 recorded a year of stable electricity production in 2024 despite high raw material prices and significant exchange rate fluctuations.

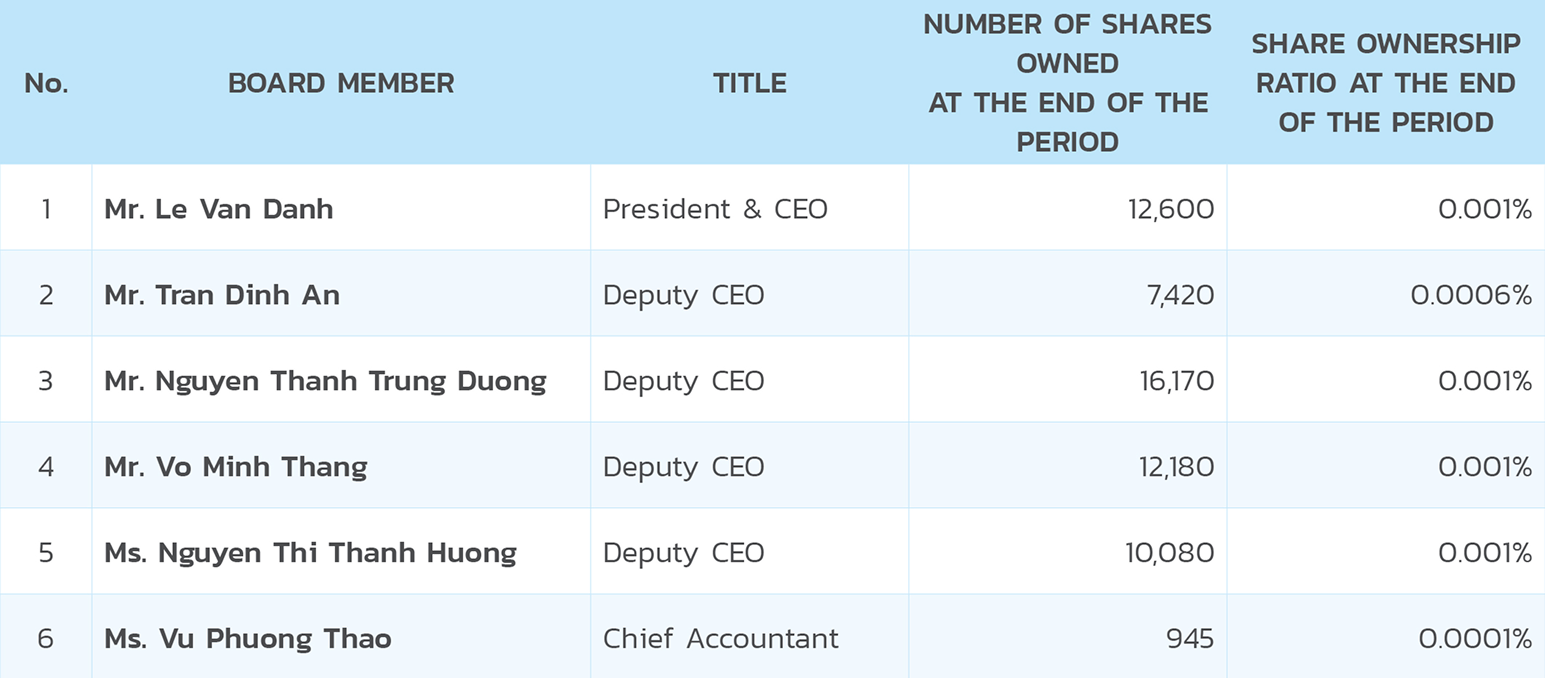

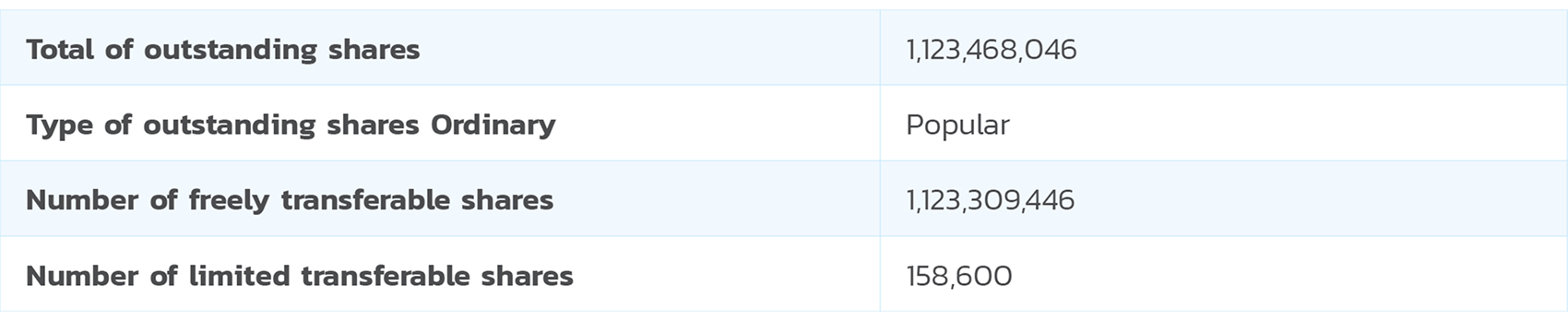

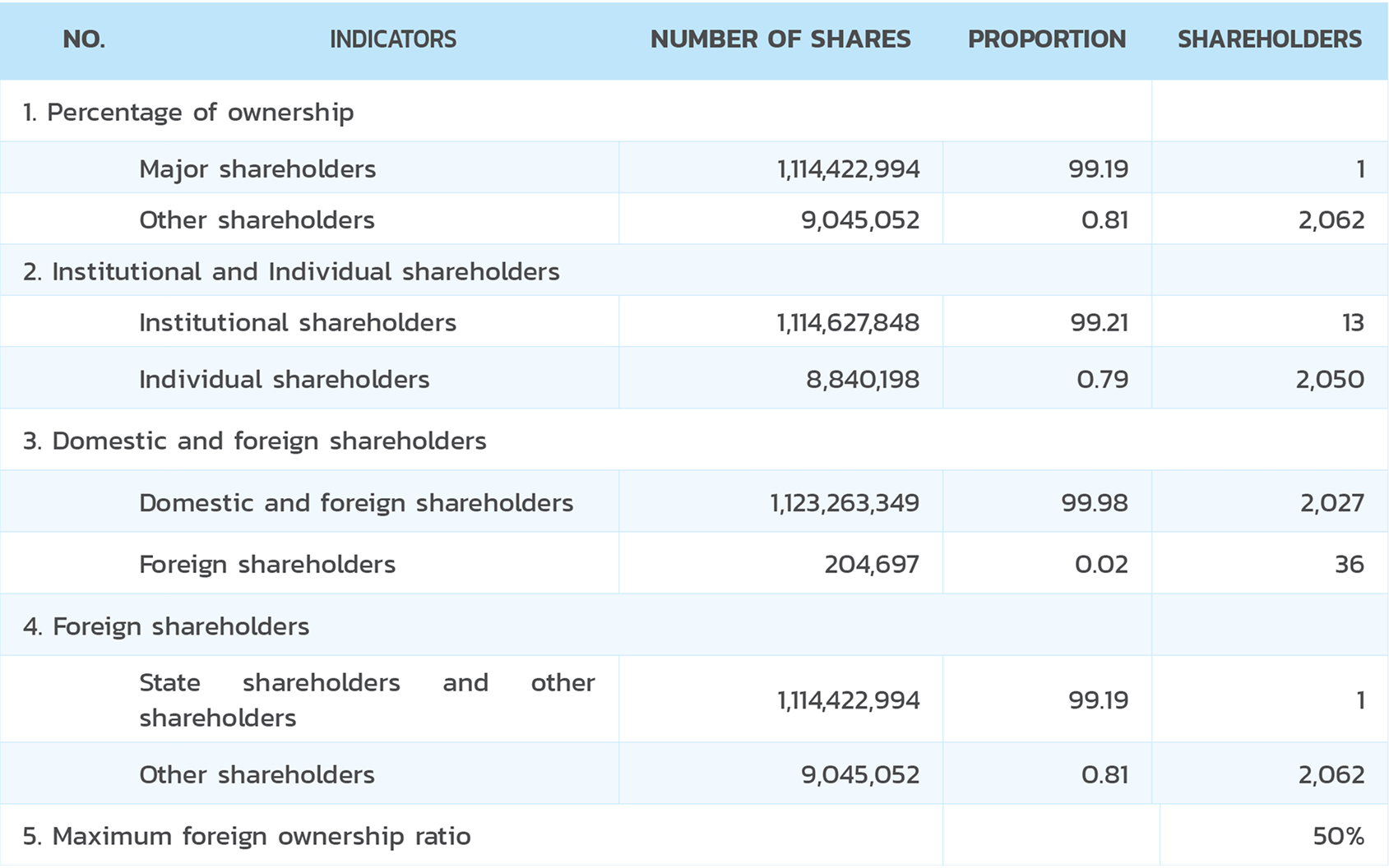

Shareholders structure, change in investment capital of owners

Share

STATUS OF CHANGES IN OWNER’S INVESTMENT CAPITAL: None

TRADING TREASURY STOCKS

Current number of treasury shares: 0 Shares.

In 2024, the Corporation will not conduct treasury stock transactions.

OTHER SECURITIES: None

Equitization settlement work: None

– Based on the Audit Report from the State Audit Office and the guidance documents from EVN/competent authorities, EVNGENCO3 has made efforts to implement and update the privatization settlement file and submitted it to EVN for the adjusted privatization settlement file according to the audit results from the State Audit Office in Document No. 1700/TTr- GENCO3 dated July 1, 2024, along with supplementary and completed documents.

– EVN, the Assistance Team, and the Equitization Directing Committee have reviewed and verified the equitization finalization documents. The Corporation has worked on, absorbed, and explained the feedback, and completed the finalization documents. On December 19, 2024, the Directing Committee issued document No. 7349/EVN-QLV+TCKT reporting to the Committee for consideration and approval of the equitization finalization documents of the Parent Company – EVNGENCO3.

– On December 31, 2024, the State Capital Management Committee approved the privatization settlement of the parent company EVNGENCO3 in Decision No. 673/QD-UBQLVNN.